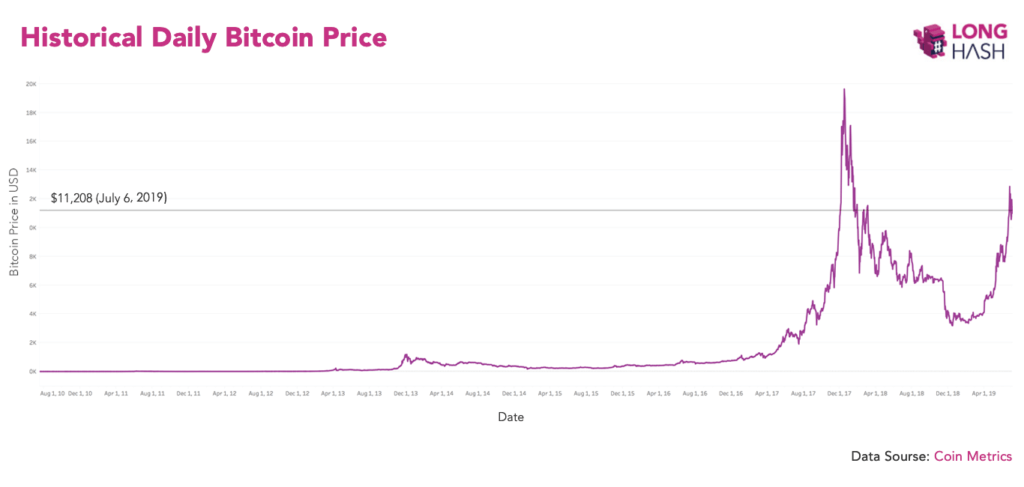

Bitcoin enthusiasts often refer to the cryptocurrency as “digital gold,” due to the perception that it is an incredible store of value. Plenty of skeptics, however, still believe Bitcoin is simply too volatile to be thought of this way.

When looking at the data, it’s clear Bitcoin still has incredible price swings over the short term, although the asset has improved its stability slowly over time.

While Bitcoin is known to have wild movements up and down on a rather frequent basis, the reality is it has really only been volatile in one direction over the long term.

Bitcoin is Almost Always a Good Buy

The Bitcoin network was launched by Satoshi Nakamoto on January 3, 2009, and as of July 6, 2019, the asset has only been a bad buy on 60 out of its 3,837 days of existence. In other words, people who decided to buy Bitcoin one day and hold it until this past Saturday made a profit 98.4% of the time.

If you only count the past five years — a time when information related to Bitcoin has been more widely known and the asset has been more heavily traded — buyers of Bitcoin would have still made a profit on 96.7% of purchase days.

Of the 60 days in which buyers would be in the red, 48 of them were during the late 2017/early 2018 crypto asset bubble. Five of the unprofitable days to buy Bitcoin have come in the past couple of weeks as the price has become more volatile.

Of course, none of this data will be comforting to those who bought Bitcoin in the $15,000 to $20,000 range back in December 2017. Having said that, it’s likely many of those who bought at that price sold shortly after the bubble popped, as the buyers at the top of a bubble tend to be those with the least conviction.

According to Messari, those who bought Bitcoin at the all-time high are still down 43% on their purchase.

This data should make clear how and when it makes sense to buy Bitcoin. For most people, dollar cost averaging will be the best option because it helps to avoid situations like making a large purchase at the all-time high. The basic idea is you buy a specific amount of Bitcoin per week or month in order to spread out the risks associated with the wild short term swings in the price.

Someone who is trying to time the market will want to wait until capitulation has occurred and long term holders are starting to buy again, as outlined by both Adamant Capital and Delphi Digital earlier this year. Of course, that’s much easier said than done.

Credit and thanks to Kyle Torpey and LongHash